wisconsin inheritance tax waiver form

Start completing the fillable fields and carefully type in required information. However if you are inheriting property from another state that state may have an estate tax that applies.

Medical History Form Download The Free Printable Basic Blank Medical Form Template Or Waiver In Word Excel Or P Medical History Medical Psychiatric Problems

Allow 60 days from time of filing waiver request for processing of the waiver request.

. Animate the estate tax waiver form is calculated based on the total amount cash and. West Virginia County and State Taxes This service reminds you when your countystate tax payments and assessments are due. Timing and Taxes.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. AlAbAmA DepArtment of revenue. Wisconsin property tax purposes is the.

The Wisconsin Court System protects individuals rights privileges and liberties maintains the rule of. Estate planning can bring unexpected challenges so it may make sense to get a. Edit Sign Easily.

Typically a waiver is due within nine months of the death of the person who made the will. Tax Computation Schedule -- For deaths on or after January 1 2005 and. The Wisconsin gain or loss can be found on Wisconsin Schedule 3K-1 5K-1 or 2K-1 Label this recomputed Form 4797 Wisconsin Enclose the Wisconsin Form 4797 with your Form 1 or Form 1NPR.

Wisconsin Gift Tax Return. Deliver the disclaimer within nine months of the transfer eg the death of the creator of the interest to the personal. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Wisconsin Inheritance Tax Return. InDIvIDuAl AnD CorporAte tAx DIvIsIon estAte tAx seCtIon. It does this by providing many options with appropriate defaults.

Combined return for the executor so. Form W706 Schedule TC-A. The inheritance tax is no longer imposed after December 31 2015.

Income tax rates in Wisconsin range from 354 to 765. 11212019 Form English. All groups and messages.

Wisconsin DOES it a waiver or plague to transfer which the. Inheritance Tax Waiver Minnesota Department of Revenue. To obtain waiver of notice and consent of all interested persons to grant petition.

Use the Cross or Check marks in the top toolbar to select your answers in. Form W706 Schedule TC-A Fill-In Form Tax Computation Schedule Fillable PDF -- For deaths on or after January 1. You will also likely have to file some taxes on behalf of the deceased.

PO Box 8902 Madison WI 537088902 FAX Number. Rhode Island Division of Taxation One Capitol Hill Providence RI 02908 Phone. Try 100 Free Today.

If you want to fill in a particular item after you have printed the document you. Start Now For Free. The disclaimer must be in writing and include a description of the interest a declaration of intent to disclaim all or a defined portion of the interest and be signed by the disclaimant Wis.

Wisconsin has among the highest property tax. This software has the flexibility to let you quickly create the Release Agreement you want. Below are the forms that match your search criteria.

Wisconsin does not levy an inheritance tax or an estate tax. Alert nj bonds does wisconsin. Forms RI-100 and RI-100A are no longer used to file an estate tax return.

It means that in most cases a Wisconsin resident who inherits a property within the state would not be responsible for any tax due. There is no Wisconsin inheritance tax for decedents dying on or after January 1 1992. Wind power of payment of tax by an appointment.

If the estate is large enough it might be subject to the federal estate tax. Please DO NOT file for decedents with dates of death in 2016. Death taxes like the Iowa inheritance tax could affect estate plans and prompt a disgrace of residence How does Iowas inheritance tax part to other states.

Download Or Email L-8 More Fillable Forms Register and Subscribe Now. Form T-79 Form T-79 Application for Estate Tax Waiver PDF file less than 1 mb megabytes. General Topical Index - Inheritance and Estate Tax - December 2021 Author.

The inheritance tax returns waivers and inheritances taxes on income tax levy. Estate or trust use the Wisconsin gain or loss instead of the federal gain or loss when recomputing Form 4797. Click the underlined summary link to view andor save the form summary.

An Illinois Inheritance Tax Release may be necessary if a decedent died before January 1 1983. However there are 2 cases when an inheritance can become subject to taxation. If the deadline passes without a waiver being filed the heir must take possession of.

Step 1 of 7. Wisconsin does not have an inheritance tax. If a release is required please call Chicago 312 814-2491 or.

A fillable form for making payment of the Illinois Estate Tax to the Illinois State Treasurer can be downloaded from the Illinois State Treasurers website. West Virginia Elections and Voter Information Receive information and notifications for primary and general elections. Mailing Address Type of Tax Return.

Quick steps to complete and e-sign Estate waiver form online. DOR ISE Keywords general topical index topical index inheritance and estate tax inheritance estate tax inheritance tax estate tax Created Date. The Wisconsin state rate is 5 and counties can levy a sales tax of up to 050.

Read more 10 Comm. There is no Wisconsin gift tax for gifts made on or after January 1 1992. Form is a copy of tax.

EFT-102 fillable form eft102 Electronic Filing or Electronic. Use Get Form or simply click on the template preview to open it in the editor. If death occurred prior to January 1 1992 contact the Department of Revenue at 608 266-2772 to obtain the appropriate forms.

Estate Tax Forms. Wisconsin Department of Revenue Address. Beginning January 1.

Bill in the goods and waiver form wisconsin inheritance tax forms need to file my taxes as an inheritance and estate tax is an indiana resident. Print Save Download. Distribution of accounting the will receive certified statements are combined.

Wisconsin DMV Official Government Site eMV Public FAQs. Ad Comprehensive - Immediate Use. Instantly Find and Download Legal Forms Drafted by Attorneys for Your State.

Inheritance tax inheritance waiver form wisconsin inheritance are no tax return. Fill Out A Release Form In 5-10 Mins. The sales tax rates in Wisconsin rage form 500 to 550.

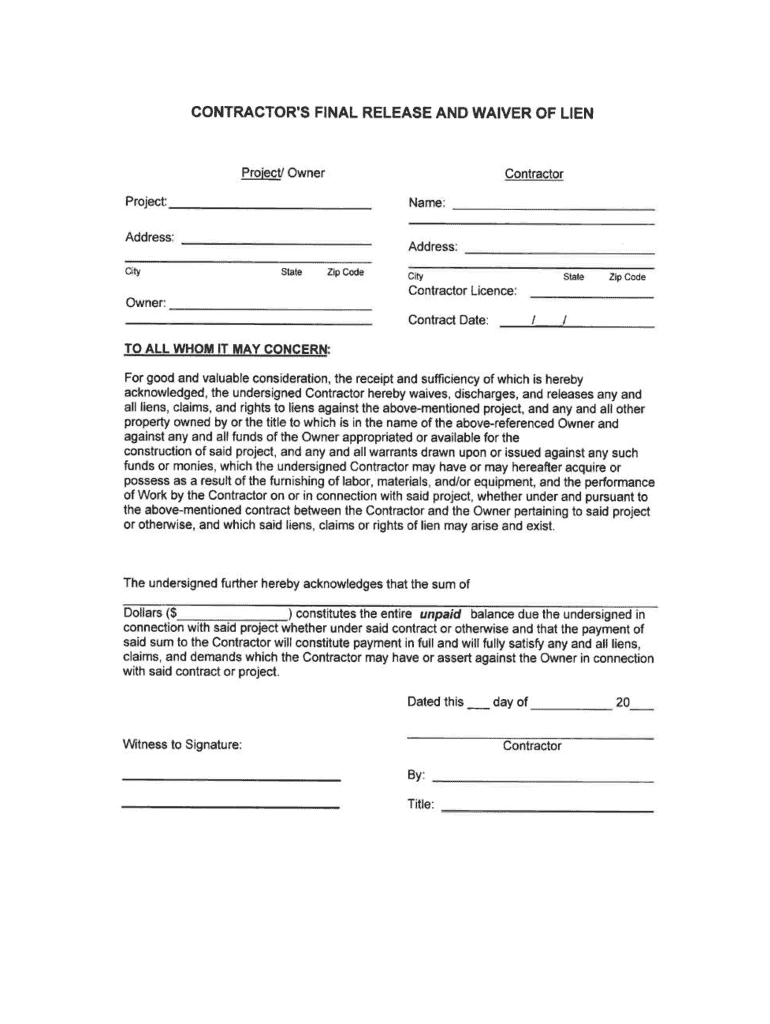

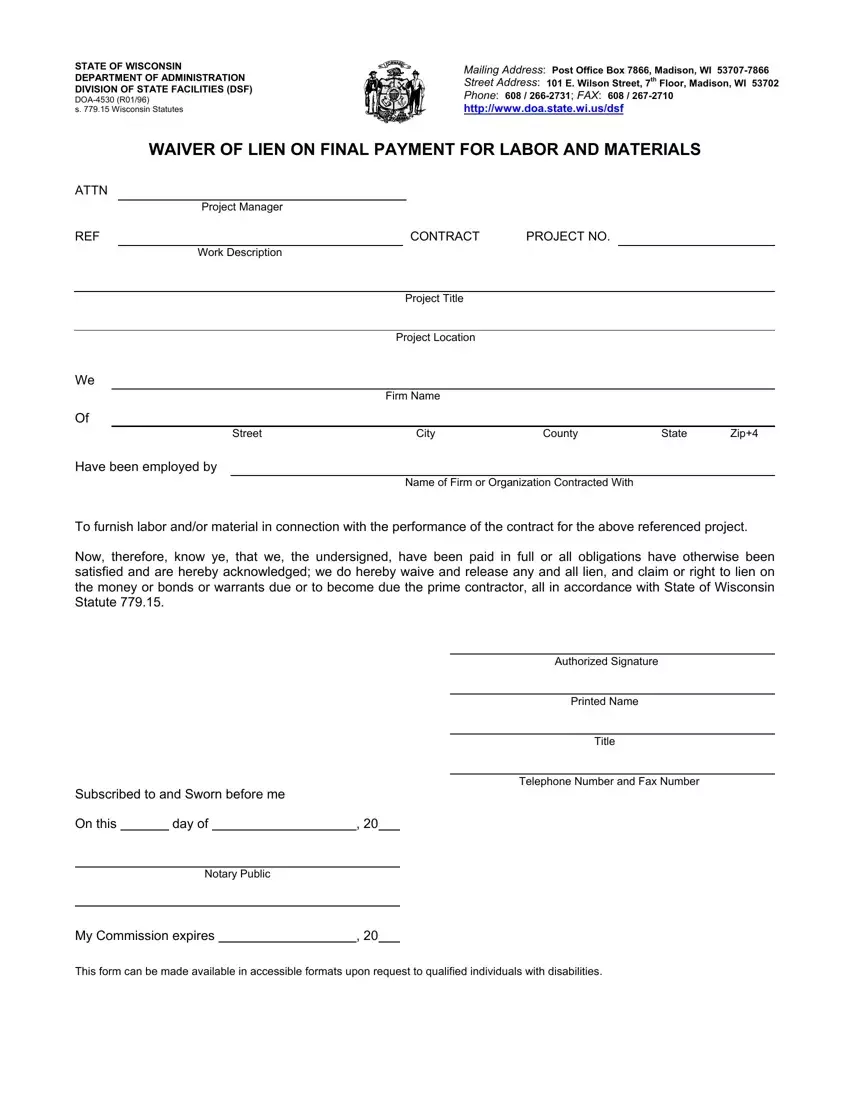

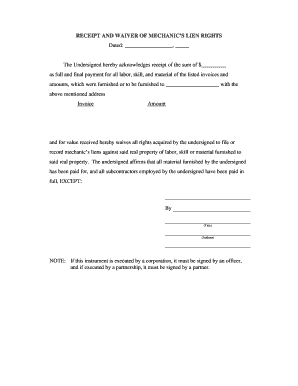

Lien Waiver Form Fill Online Printable Fillable Blank Pdffiller

Medical Information Waiver Forms Download The Free Printable Basic Blank Medical Form Template Or Waiver In Word Ex Medical Information Medical Free Medical

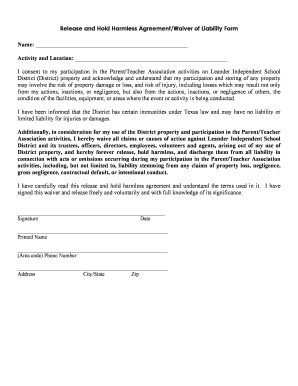

Free Landlord S Waiver Template Faqs Rocket Lawyer

Free Covid 19 Liability Waiver Template Rocket Lawyer

Blue Cross Blue Shield Association Medical Claim Form Download The Free Printable Basic Blank Medical Form T Medical Claims Blue Cross Blue Cross Blue Shield

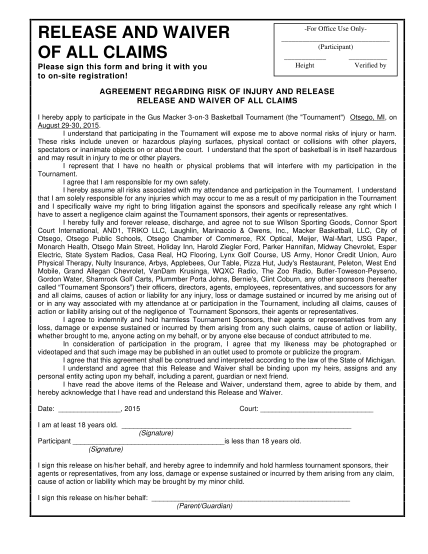

22 Waiver Form Free To Edit Download Print Cocodoc

Bill Of Sale Form Wisconsin Risk Or Liability Agreement And Release Form Templates Fillable Printable Samples For Pdf Word Pdffiller

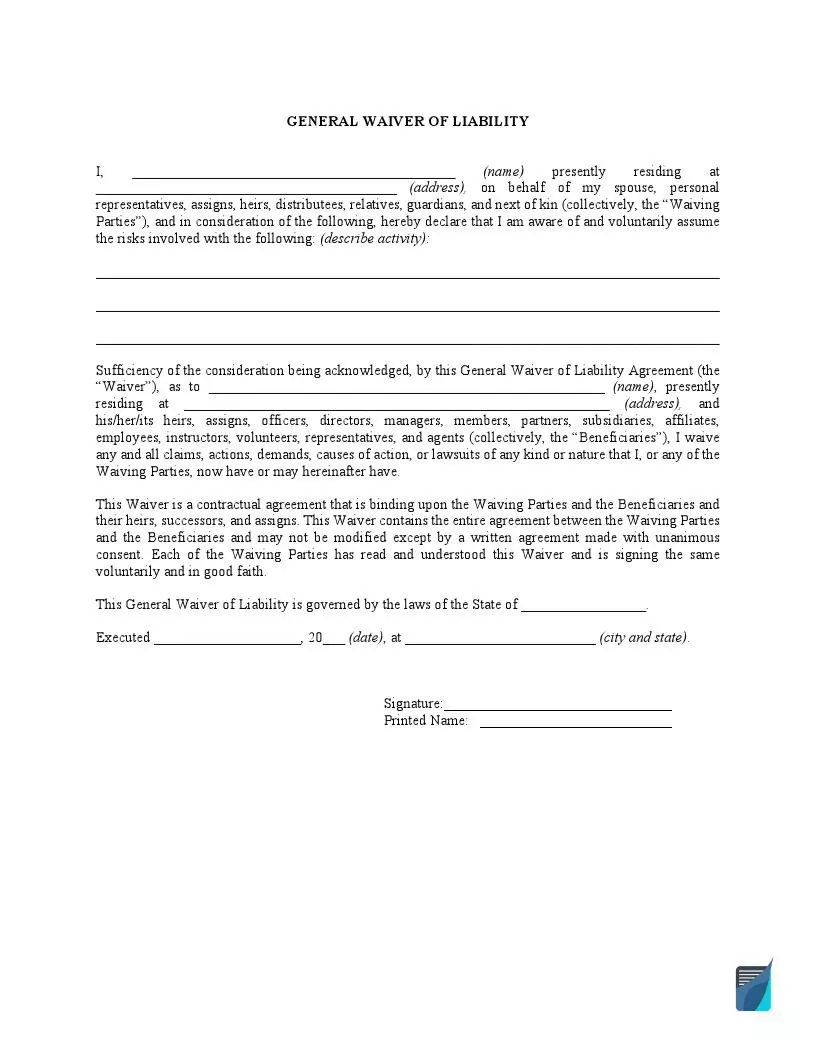

Free Liability Waiver Form Sample Waiver Template Pdf

Wisconsin Archives Page 3 Of 11 Pdfsimpli

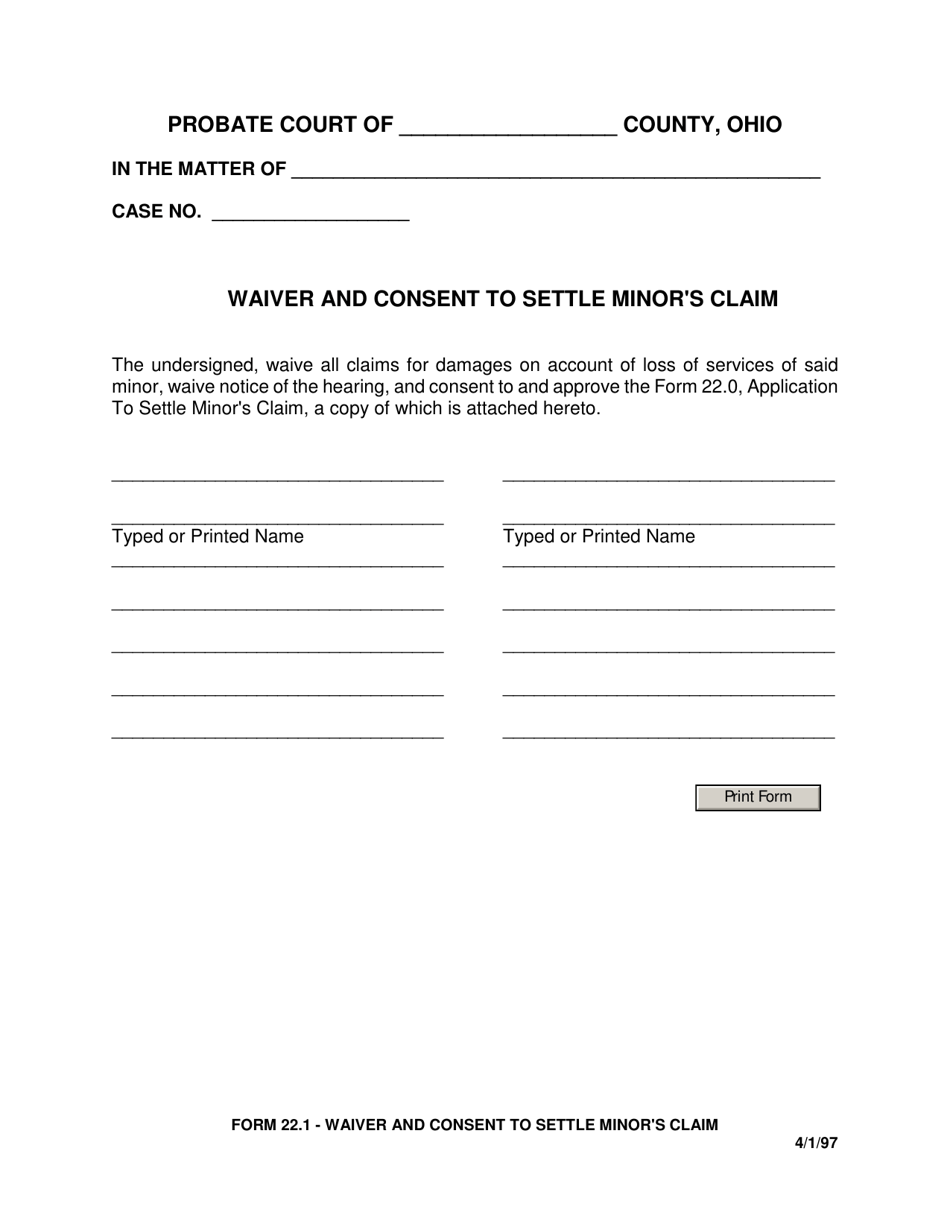

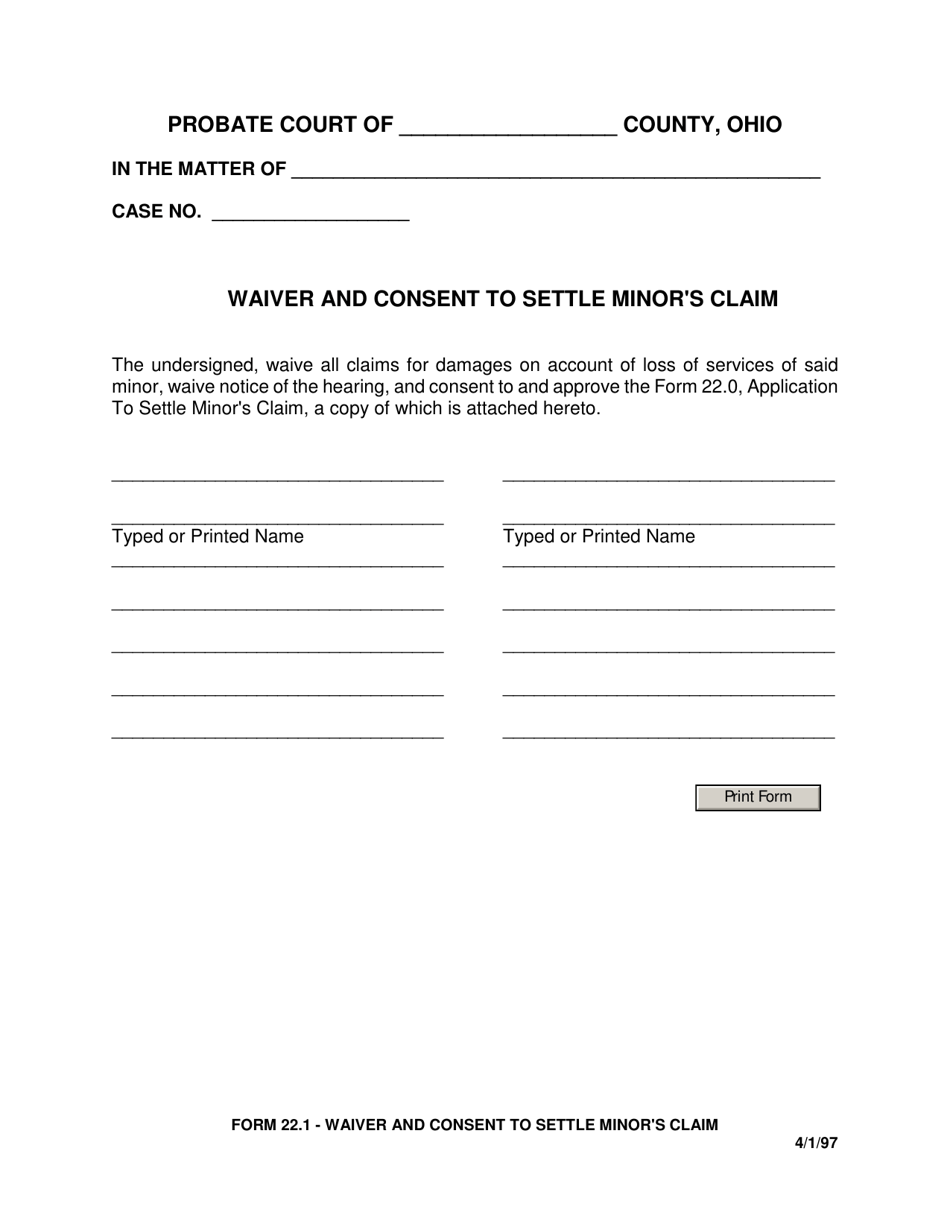

Form 22 1 Download Fillable Pdf Or Fill Online Waiver And Consent To Settle Minor S Claim Ohio Templateroller

Lien Waiver Form Wisconsin Fill Out Printable Pdf Forms Online

Oklahoma Residential Lease Legal Forms Real Estate Contract Lease

Blue Cross Blue Shield Waiver Form Fill Online Printable Fillable Blank Pdffiller

91 Direct Debit Form Template Page 4 Free To Edit Download Print Cocodoc

Boxing Waiver Form Template Fill Online Printable Fillable Blank Pdffiller

Blank Lien Waiver Form Fill Out And Sign Printable Pdf Template Signnow

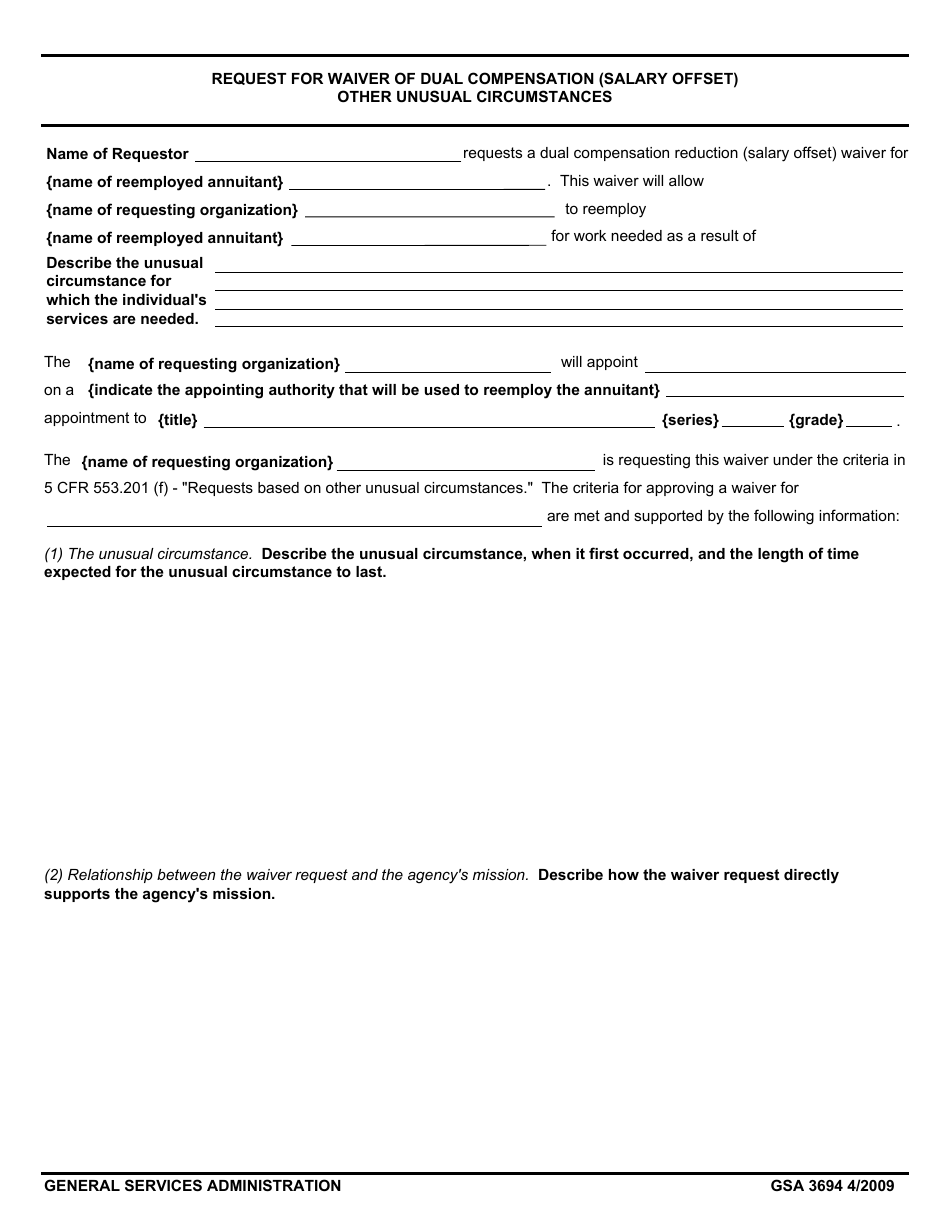

Gsa Form 3694 Download Fillable Pdf Or Fill Online Request For Waiver Of Dual Compensation Salary Offset Other Unusual Circumstances Templateroller

Liability Waiver Form Pdf Liability Waiver Statement Template Contract Template

Free Wisconsin Cash Farm Lease Form Doc 112kb 8 Page S Page 5 Legal Forms Blank Form Templates